Cryptocurrencies have significantly impacted various sectors, including finance, technology, and even the real estate market. As digital currencies like Bitcoin, Ethereum, and other altcoins gain popularity, many are exploring how to leverage these assets in purchasing real estate. This guide will walk you through the intricacies of buy real estate with cryptocurrency, highlighting the benefits, challenges, and necessary steps.

The Rise of Cryptocurrency in Real Estate

The Evolution of Cryptocurrency

Cryptocurrency is a form of digital currency that utilizes blockchain technology to secure and verify transactions. Bitcoin, the first cryptocurrency, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of cryptocurrencies have emerged, each with unique features and use cases. As these digital assets have gained legitimacy and value, their application in various markets, including real estate, has expanded.

Why Use Cryptocurrency for Real Estate?

The primary appeal of using cryptocurrency for real estate transactions lies in the potential for faster, more secure, and cost-effective transactions. Traditional real estate deals often involve multiple intermediaries, extensive paperwork, and significant time delays. Cryptocurrency can streamline this process, reducing transaction times and costs while offering a higher degree of security and transparency through blockchain technology.

Steps to Buying Real Estate with Cryptocurrency

1. Finding Crypto-Friendly Properties

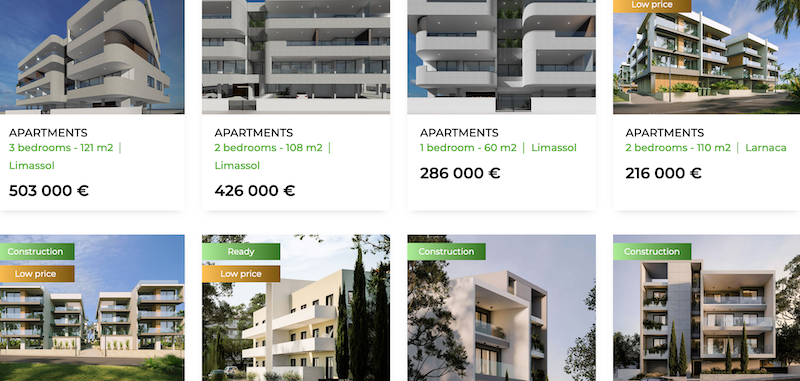

The first step in purchasing real estate with cryptocurrency is to identify properties that can be bought with digital currency. Several websites and platforms specialize in listing properties available for cryptocurrency purchases. Websites like Bitcoin Real Estate, Propy, and Cryptohomes help bridge the gap between crypto enthusiasts and real estate markets, providing listings and facilitating transactions.

2. Engaging a Knowledgeable Real Estate Agent

Working with a real estate agent experienced in cryptocurrency transactions is crucial. These agents understand the nuances of digital currency and can guide you through the process, ensuring all legal and regulatory requirements are met. They can also help negotiate terms that account for the volatility of cryptocurrency values.

3. Conducting Due Diligence

Due diligence remains essential regardless of the payment method. Verify the legitimacy of the property, check for clear title, and ensure there are no legal encumbrances. Additionally, it's wise to consult with legal experts who specialize in both real estate and cryptocurrency to navigate any potential regulatory challenges.

4. Structuring the Transaction

Structuring a real estate transaction with cryptocurrency involves a few unique considerations. The parties must agree on the type of cryptocurrency to be used and determine a method for valuing the digital currency to mitigate volatility risks. Some transactions might involve converting cryptocurrency to fiat currency through a third-party service to facilitate the deal.

5. Completing the Purchase

Once the terms are agreed upon, the purchase can proceed. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can be utilized to automate and secure the transaction. These contracts execute automatically when predefined conditions are met, ensuring a transparent and tamper-proof process.

Benefits of Buying Real Estate with Cryptocurrency

Speed and Efficiency

Cryptocurrency transactions can drastically reduce the time required to complete real estate purchases. Traditional processes involving banks and other intermediaries can take weeks or even months, whereas cryptocurrency transactions can be completed in a matter of minutes or hours.

Lower Costs

By eliminating intermediaries like banks and escrow services, transaction costs can be significantly reduced. Additionally, blockchain technology's transparency can minimize the need for extensive due diligence, further cutting costs.

Enhanced Security

Blockchain technology provides a secure and immutable ledger of all transactions. This feature reduces the risk of fraud and ensures the integrity of the transaction, offering peace of mind to both buyers and sellers.

Global Reach

Cryptocurrencies facilitate cross-border transactions without the need for currency conversions or dealing with international banking regulations. This global reach opens up new markets and opportunities for both buyers and sellers.

Challenges and Considerations

Volatility

The volatile nature of cryptocurrencies can pose a significant risk. Price fluctuations can affect the transaction's value, making it essential to agree on valuation methods and consider using stablecoins—cryptocurrencies pegged to stable assets.

Legal and Regulatory Landscape

Cryptocurrency regulations vary by country and region. It's crucial to understand and comply with local laws to avoid legal issues. Consulting with legal experts in both real estate and cryptocurrency is advisable.

Security Risks

While blockchain technology is secure, the risk of hacking and cyber theft remains. Using secure wallets and platforms, along with additional security measures like multi-signature wallets and hardware wallets, is essential to protect your assets.

Tax Implications

Cryptocurrency transactions can have tax implications, including capital gains taxes. It's important to consult with tax professionals to understand your obligations and ensure compliance with tax laws.

Conclusion

Buying real estate with cryptocurrency is an exciting and innovative approach that offers numerous benefits, including speed, efficiency, and enhanced security. However, it also presents unique challenges such as price volatility and regulatory complexities. As the adoption of cryptocurrency continues to grow, staying informed and seeking professional guidance will be crucial for navigating this evolving landscape successfully. With the right knowledge and preparation, purchasing real estate with cryptocurrency can be a seamless and rewarding experience.

It’s possible to make a deal for place Your yachting marine industry articles on these domains

Yacht News and Marine Industry Guest Posting Sites

https://seayachtingmagazine.com/yachts-news

https://easybranches.com/lifestyle/yacht

https://worldnews.easybranches.com/lifestyle/yacht

https://marineluxurylifestyle.easybranches.com/n

Our real-time page visitors and more websites:

https://visitors.easybranches.com

Listing Packages:

https://marineluxurylifestyle.easybranches.com/packages

Yachts for sale and Charter:

https://marineluxurylifestyle.easybranches.com/y

Instagram @EasyBranchesMarine

Contact info@easybranches.com